Seed of a (Hydrogen) Revolution

Hydrogen will be a major green fuel source of the future; it starts in places like this.

Just a reminder that my climate and energy newsletter will be launching soon, as part of Semafor. We’re very excited for the launch of this ambitious new global news organization. You can sign up to receive my newsletter here.

Today, hydrogen….

The collection of pipes, pumps and an electrolyzer outside the ancient city of Bikaner is tiny for an industrial facility. But this is among the seeds that will eventually grow into a branch of the energy industry worth hundreds of billions of dollars globally.

Few emerging energy technologies have been hailed as far and wide as green hydrogen. The process starts with water, adds electricity and results in a fuel, hydrogen, that simply reverts back to water and oxygen when used as an energy source. When made with renewable energy, it’s clean as a whistle.

Hydrogen can be stored for months in the form of ammonia, a chemical compound the world already regularly deals with in its liquid form. In this guise, hydrogen can also be shipped relatively easily. It can also be conveniently manufactured when wind and solar electricity production exceed demand during peak sunshine. Hydrogen burns hot, so it can replace dirty coking coal in steel plants. There’s already a large market for hydrogen in oil refining and to make agricultural fertilizers. It’s just dirty hydrogen — meaning produced through a process that emits lots of carbon dioxide — that could be replaced by the green stuff, if it can be made cheap enough.

“Fertilizers and chemicals are markets that are already there, they just need to move from grey to green,” said Devang Singh, an ACME exec who showed me around.

Industry experts are confident hydrogen can be made cheap enough — as long as we make a lot of it. Indeed, with the huge spike in natural gas prices over the past year green hydrogen may already be cheap enough. And it’s going to get much cheaper.

All of that has raised hopes that green hydrogen will help with some of the toughest challenges of the energy transition: storing green energy and cleaning up industries like fertilizer production, steel making, shipping and perhaps even aviation.

I toured this pilot project, operated by ACME Group, one of India’s leading renewable energy companies, earlier this year when it was the only operating commercial green hydrogen facility in the world. ACME set up the plant in early 2021. By the middle of that year, it was deploying five megawatts of solar energy to power a single 2.5 Megawatt electrolyzer. The plant makes five tons of green ammonia per day.

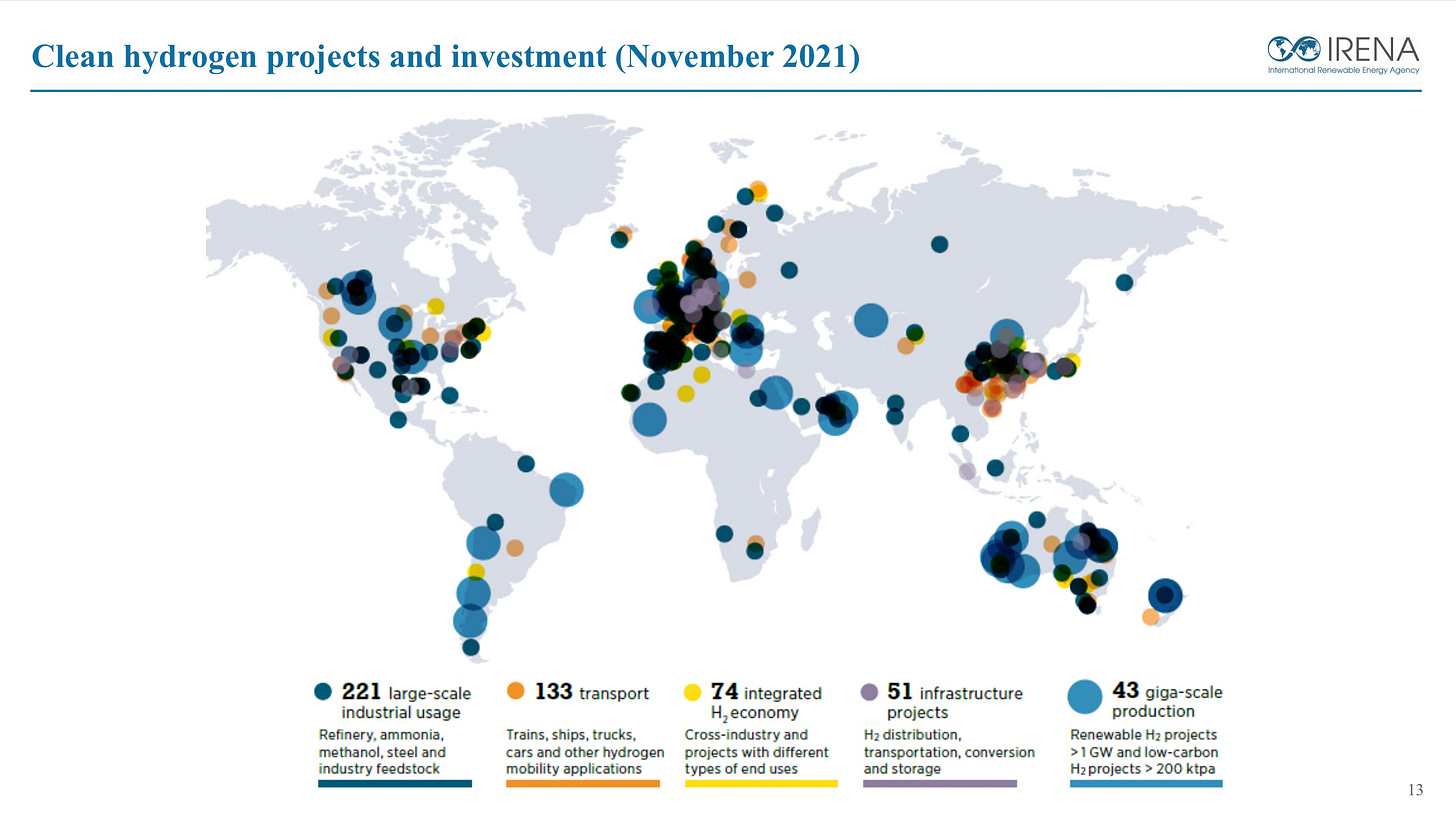

From this, and a handful of other pilot projects around the world today, a massive industry will rise. According to the International Energy Agency’s (IEA) at least eight megatons of hydrogen to green ammonia production capacity is planned worldwide, one and a half million times what’s being produced in Bikaner. More broadly, the International Renewable Energy Agency projects that more than one-tenth of the energy the world consumes in 2050 could come from hydrogen. Much of that will come from places like India — and Australia and Chile, North Africa and the Western United States — that have plentiful cheap renewable energy that can drive up volume and push down costs. Some of India’s biggest companies have jumped on the hydrogen bandwagon, including Reliance Industries, Adani Group, national power company NTCP, Renew Energy and Indian Oil Co. They’re leveraging India’s sun-drenched northwest deserts and other prime solar energy sites. ACME has announced a $7 billion investment to a plant in Karnataka state in southern India, another hot spot for clean energy production. Many of them are already looking abroad for markets, as well. ACME is building a plant in Oman that will deploy 60-70 electrolyzers to produce six times as much ammonia as the Bikaner plant. Virtually all of it will be exported to places like Europe and Japan, transforming Oman’s main exports from oil to hydrogen.

The project in Bikaner is a learning exercise. Right now, green ammonia is at least double the price of ammonia produced through the conventional methodology, which produces large amounts of carbon dioxide. But many experts believe the industry is on the same sort of turbo-learning curve that has sent solar power and battery storage costs tumbling by 80-90% in recent years. Reliance, for example, is aiming to cut the cost of green hydrogen to less than a dollar by 2030, and is investing some $70 billion into green hydrogen to do it. The company plans to replace its current production of hydrogen made the dirty way, with natural gas, in its refineries (the biggest of which you’ll recall we visited earlier). That would help India massively reduce the amount it pays each year to import natural gas.