Coal to Hydrogen by way of Renewables

My last stops Down Under: a coal port, a solar center and an electrolyzer plant

Apologies for the recent quiet here at the Energy Adventure(r). I’ve been busy getting out stories from my Asian travels during the first half of the year through some other channels. These include my first story (and photos!) published via the Associated Press, which is partnering with Cipher on climate coverage.

I’ll post here soon pulling together all the links to stories on other platforms with some thoughts about Asia’s central importance in the global energy transition.

For now, we wrap up the adventure Down Under by focusing on what’s turned out to be a leitmotif: the advance of renewables, especially solar, in Australia, the potential for so much more, and what to do with so much cheap energy.

Martin Green oversees an impressive solar power research laboratory at the University of New South Wales in Sydney — one fitting of a guy present at the creation of the modern solar industry, who, indeed, helped create it.

His story is oft-told, but worth repeating. Prof. Green began in solar as Ph.D student in Canada way back in the 1970s, when the main applications for solar power were in space. Research had begun on those in the 1950s in the now legendary Bell Labs, a subsidiary of American Telephone & Telegraph.

I met Green at his cavernous, sunlit lab at the center of the campus. It is filled with sensors, gauges, meters and other equipment, everything a man often called the Godfather of the modern solar panel could ever need.

When outer space was the focus, efficiency became the only goal in making solar panels. Capturing as much of the power of sunlight as possible with each square inch of panel was all that mattered. This was NASA in its heyday — costs no impediment.

“By 1983 we’d set a world record for efficiency,” Green told me.

One of Green’s research tasks, initially, was determining the outer limits of efficiency, theoretically. How much of the energy in sunlight could the standard solar panel made of silicon, still the main material the industry is built upon, convert into electricity?

Green and his fellow researchers worked out that the absolute maximum that could be obtained using panels made of silicon was around 29%, meaning the material had the theoretical capacity to convert almost one-third of the energy in the sunlight hitting them into usable electricity. Back then panels were pushing 20% efficiency.

Starting with the oil crises of the 1970s, solar started looking like a possible alternative to coal and oil, with their volatile price swings and unsavory international entanglements.

But here on earth costs mattered. The cost of solar was high.

That sent renewables into hibernation for the next three decades. But a few researchers kept plugging away, none more so than Green. He returned to his native Australia and began overseeing a graduate research program that set new records for the efficiency of silicon panels for decades.

But making the panels themselves was still costly. No one had really focused on how to make them as inexpensively as possible — largely a manufacturing challenge.

In the late 1990s, some of Green’s exchange students from China returned home and took up this challenge.

One of his early students, an ambitious Chinese researcher named Shi Zengrong, set up a company called Suntech Power. His timing dovetailed perfectly with a fevered rush by U.S. investors to get in on the China manufacturing miracle just after the turn of the millenium. Goldman Sachs was an early investor. Suntech became the biggest technology initial public offering on the NASDAQ stock exchange in 2005. Green helped ring the opening bell when the company’s shares began trading.

Still, another decade elapsed before the next big chapter of the solar success story unfolded. Even as efficiencies inched higher and manufacturing costs ratcheted lower, demand for solar panels remained pretty muted. Then Germany began to see solar as a way to clean up its energy system, by substituting for coal, while also replacing its controversial fleet of nuclear reactors.

The resulting explosion of demand was met by Chinese manufacturers, to the still-painful recollection of the then dominant panel-makers in Germany, the U.S. and Japan. As Chinese factories churned out more and more panels in each of their increasing number of factories, the cost per panel plummeted. Panel prices fell off a cliff.

Fast forward to just before the covid pandemic and the triple-witching effect of efficiency gains, manufacturing improvements and economies of scale pushed panel prices well below 10% of what they were back in 2014.

Prices rose during the covid-induced global supply chain foul-ups and subsequent rise in international trade tensions. But today they’re again falling sharply as Chinese leaders, concerned about their flagging economy, have encouraged production far beyond China’s own, very considerable, demand for panels. They haven’t limited themselves to solar either. They supercharged production of wind turbines, nuclear and batteries, as well.

That’s left renewables poised to make their most important contribution yet to a global energy transition, one that desperately needs accelerating if we’re to even partly avoid the worst fallout from global warming.

Why?

When I began writing the Energy Adventure(r) more than three years ago, the state of the world’s transition was trifurcated, so to speak.

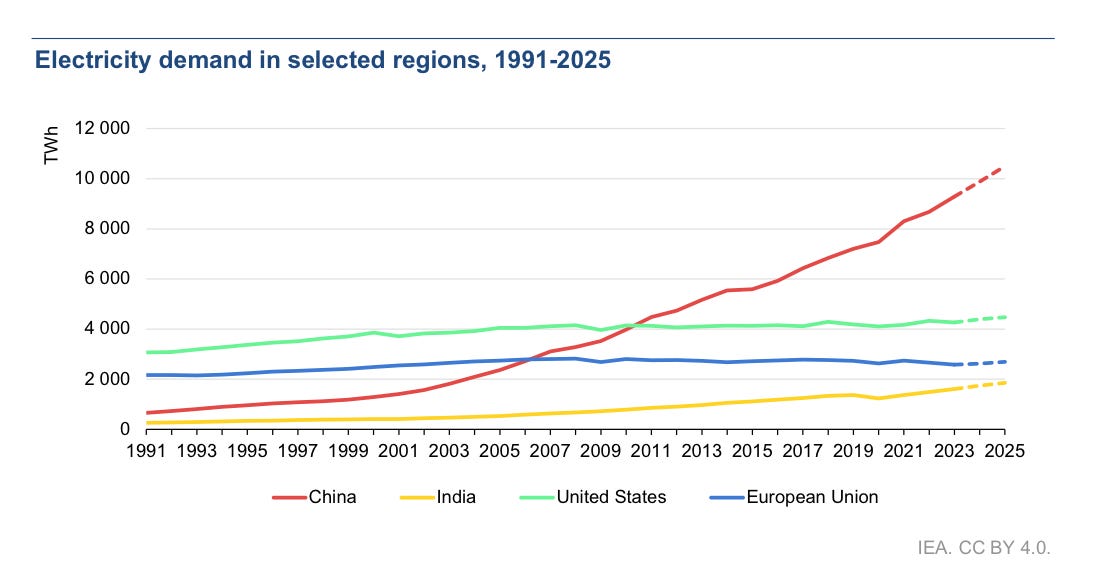

Developed countries like the U.S. were using about the same amount of energy year after. Slowish economic growth was matched, or even overtaken, by gains in energy efficiency. Developing countries — first China, then India and Southeast Asian upstarts Vietnam, Indonesia and Malaysia — were seeing energy growth, and accompanying greenhouse gas emissions, gallop ahead along with economic growth. Undeveloped countries — mainly in Africa but also Asia and Latin America — hadn’t really even started consuming modern energy.

That’s all changed. Africa has emerged. India is booming.

Those developments were expected. The surprise is in the developed world: Suddenly energy demand has kicked back into growth mode. And not just makeup growth mode, like we saw during the recovery from the global financial crisis in 2008 and after the lifting of Covid lockdowns in 2022 and 2023.

There’s a new structural ratcheting up in demand, coming from two sources.

The first is a surge in construction of computer data centers, many of them for tech companies racing to develop artificial intelligence offerings. Since developing these offerings — puzzling out the algorhythms and training them on vast stores of data — also voraciously consumes power, demand for energy is likely to keep growing even after the construction phase of AI mania subsides.

The second is a push toward electrifying much of what we do with fossil fuels today: transporting ourselves (with electric vehicles instead of petrol and diesel powered cars and trucks), heating our homes and offices (electric heat pumps instead of gas and oil furnaces), and producing industrial products (like steel).

How will all this new global demand be met?

In the longer term, possibilities abound — atomic fusion (which I wrote about for Cipher here), advanced nuclear , geothermal energy from the center of the earth, and others. Some of those may well take the baton some time after 2035.

Meanwhile, the task is more about how to get more out of the renewable technologies up and running today with potential not even close to fully tapped.

One answer seemed to be emerging in Australia. My reporting began in South Australia, the lead horse on a continent emerging as a renewable energy powerhouse. Three out of four homes in the state have solar panels on their roofs. Two thirds of the state’s electricity already comes from wind and solar power, and the government aiming to make that 100% within a mere three years from now.

You can read more about all this in this story I wrote for Cipher.

On one of my last days in Australia I found myself in the town of Wollongong, in an industrial enclave along the country’s east coast. The Port Kembla steel mill, one of the country’s largest, operates here, as it has for nearly a century. Still pock-marking the beach are the huge concrete spikes, dubbed “Dragon teeth,” placed here during World War II to stop any attempted invasion by Axis powers. Nearby sits a shipping mine that’s been dragged out from the depths, where it once was placed to sabotage any lurking German submarines, and surrounded by picnic tables.

I had come not to see the steel plant, but instead a new factory set up to make what are known as electrolyzers. These devices deploy electricity to separate water into oxygen and hydrogen, the latter of which can be used to do everything from storing clean electricity to making clean steel. South Australia is one of dozens of renewable-rich regions hoping to cash in on these new ways of utilizing clean wind and solar power that routinely far exceeds the state’s electricity demand much of each day.

To do that, the world will need many more electrolyzers. Hysata is one of the companies aiming to provide those.

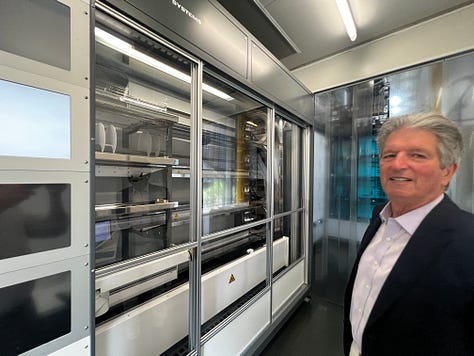

I met Paul Barrett, the company’s chief executive, on the beach and he took me through the plant. The factory, gleaming new to the eye, rests on a steel frame that was constructed some 70 years ago, Barrett told me.

Barrett is a venture capital guy who teamed up with an academic researcher at Wollongong University, Gerry Sweigers, to launch Hysata. The company is attempting to commercialize a unique electrolyzer design that Sweigers, an electrochemist who has been researching electrolyzers for decades, came up with in his laboratory.

The company, whose investors include venture capital arms of British energy giant BP and the Korean steelmaker POSCO, is focused on supplying its electrolyzers to make hydrogen for heavy industry and transportation.

Barrett, a Brit, was bullish about the prospects for his adopted country.

“There’s a huge opportunity for Australia to become an electro-state. The last 50 years of energy and geopolitics have been dominated by petro-states in the Middle East, Russia and parts of America that had these fossil fuel resources,” he told me. “In the same way, there’s an opportunity for Australia to leverage its amazing coastline and deserts that have off-the-charts wind and solar resources.”

Bravo! Thanks for your superb reporting!